How to start a startup in India – 15 Chapter Detailed Guide you need to learn.

People often ask questions on my Youtube Channel about how they can start a startup

2 Minute Summary

A startup is a company that is in the early process of growth focussing on its capitalization by developing products or services and catering market demand.Today, How to start a Startup is a major Question and also a question of threat as 90% startups fail in the first year only and other 50% in next 5 Years. In this there are various steps which includes Idea evaluation, Marketing and sales. Also it includes pilot of a product which is very important, it is like testing your product first and after taking feedback of a smaller audience and then lauching it for public. This also include how to finance your startup which is offcourse the most important part of whole journey of a startup. Also it includes 3 ways like Bootstrapping, Equity, and Debt. For Info Read the Blog

What is the procedure to start a startup in India?

From where I should start?

What if my startup fails?

According to Forbes, about 90% of startups fail.

Why does this happen?

After reading this startup guide, you will get to know everything you need to know about startups.

What’s in it for me?

1. What is a Startup? Startup vs business

A startup is a company that is in the early process of growth focussing on its capitalization by developing products or services and catering market demand.

Formed by a group of entrepreneurs, a startup is usually started from scratch with little or no investment.

Startup tests your entrepreneurial and convincing capabilities and has a risky component

Startups Vs Small Business

| STARTUP | SMALL BUSINESS |

| A faster rate of growth and capitalization. | Limited rate of growth as their agenda is a regular income. |

| Financed externally through investors. | Self-funded or through banks. |

| The nature of startups is disruptive as they try to bring new changes in the market. | The nature of small business is very traditional. |

2. Idea Evaluation

To evaluate an idea, it is required that you ask yourself some important questions

Which problem will the product solve?

For whom are you solving this problem & who will be your target audience.

Who are your competitors in this business and how will you differentiate yourself? Do you have something that cannot be replicated

How much market will you be able to cover?

How are you going to fund the startup?

Are you able to arrive at a solution?

When you can answer these questions, you will be able to evaluate whether the business idea will work or not.

3. Pilot run

- Test your product/service with a smaller audience. Try to get feedback from them.

- After taking feedback, try to incorporate changes in your product/service and launch it for the public.

- Give more value to the customers

4. Marketing and sales forecasting

Pilot Run gives an idea that how much your startup will earn in a year.

It is tough for a startup to predict as it is not established yet. During the process of marketing, a startup should be minimizing the cost. The use of pamphlets and billboards has become redundant. They add to the product’s cost. Therefore they should not be used. Check my playlist on marketing 101 ( 68 Videos):

The other option is Digital Marketing where you promote your product through the internet. It helps in focusing on the target audience and can be done at a very low cost for marketing the product. Check my playlist on Digital Marketing (76 Videos) :

Marketing (Lead Generation) and Sales (Conversion) go hand in hand. You should know both

5. How to finance your Startup?

How to start a startup, there is a question that comes from where will the funds come ? How we will finance our startup. There are three ways to finance a startup-:

- Bootstrapping

- Equity

- Debt

1. BOOTSTRAPPING

It is when you invest or reinvest your own money instead of borrowing from other sources. Bootstrapping uses the personal reserves of the entrepreneur or maybe his/her family members.

It is when you invest or reinvest your own money instead of borrowing from other sources.

Advantage – No dilution of control

Disadvantage – Low Rate of Growth

BOOTSTRAPPING USES PERSONAL RESERVES OF THE ENTREPRENEUR OR MAYBE HIS/HER FAMILY MEMBERS.

2. EQUITY

Equity is referred to as shareholder equity which represents the amount of money that would be returned to a company’s shareholders if all of the assets were liquidated and all of the company’s debt was paid off.

How to raise money through Equity?

There are two ways through which you can raise money through equity-:

Raise money being a private limited company-

If you are a private limited company, you can raise funds through private investors.

There are 2 types of investors-:

1. Angel Investors

- They are big businessmen like CEOs of companies

- They do not provide larger funds but give business know-how from their experience.

- Find problems in your business model and guide you.

2. Venture capitalist

- They give larger investments but no business know-how.

- Create a pool of investments by collecting funds from different investors.

- They act like share brokers by helping to collect money.

Raise money being a public company-

If you convert your company into a public company, you can raise money by issuing equity shares through SEBI. SEBI is an institution that regulates public companies and lists them on the stock exchange. A company issuing its shares for the first time, it is known as an IPO (Initial Public Offering) Suppose your company has a valuation of 100 crores and you want to dilute 10% of the control. When you issue shares worth 10 cr and if each share costs Rs.100. It means you are issuing 10 lakh shares to the public.

Trading

Trading is an act of buying and selling of shares. There are 2 types of trading:

There are 2 types of investors-:

1. Intra-day trading

Intraday trading means an investor sells his/her shares the same day they buy.

2. Long Term Trading

Long Term trading means an investor sells his/her shares after a long period.

Types of market

- Capital Market

- Money Market

- Forex Market

- Derivatives Market

Stock Exchange

Stock Exchange is an institution where all the stocks like shares, derivatives, etc traded. There are 2 stock exchanges in India

1. Bombay Stock Exchange – BSE

Bombay Stock Exchange is one of the oldest stock markets and first for Asia. Here approximately 5000 companies and listed on which trading is done.

2. National Stock Exchange – NSE

National Stock Exchange was formed in 1993. Here around 1600 companies are listed.

Points to be Noted for an Investor -:

- The share market is not gambling. If you know the stock market, you can easily earn good returns by investing in it.

- Choose an appropriate sector to trade upon of which you have knowledge and experience like a B. Tech should focus on trading in computer companies.

- Diversification of funds is necessary as it will lower the risks and probably increase profits.

- Share markets give at-least 15% return if you have good knowledge and experience of trading.

3. DEBT

Employed by several companies and people as a technique of creating massive purchases that they might not afford beneath traditional circumstances.

It is the quantity of cash borrowed by one party from some other party.

This is a debt arrangement offering the borrowing party permission to borrow cash on the condition that has to be paid back at a later date, with interest.

How to raise money through Debt?

Recalling what I discussed, Debt is when you borrow money from outsiders on the promise that you will return the money, particularly with interest.

Employed by several companies and people as a technique of creating massive purchases that they might not afford beneath traditional circumstances. It is the quantity of cash borrowed by one party from some other party.

This is a debt arrangement offering the borrowing party permission to borrow cash on the condition that has to be paid back at a later date, with interest.

There are two types of Debt:

SHORT TERM DEBT

Short term debts are those debts that have to be paid within one year of borrowing. These are various types of short term debts available in the market. Some of them are explained below.

1. BANK LOANS

Bank Loans are a very common type of short term debt. As the name suggests, it means a loan or debt borrowed from banks at a certain rate of interest. A Startup that is very new in the business should take bank loans to establish the infrastructure because they are easy to take.

2. COMMERCIAL PAPER

Commercial Paper is an unsecured, short-term debt instrument issued by a company for the financing of accounts payable and inventories and meeting short-term liabilities.

3. CERTIFICATE OF DEPOSIT

A Certificate of Deposit is a money market instrument that is issued in dematerialized form for funds deposited in a bank for a specific period. The Reserve Bank of India (RBI) issues guidelines for Certificate of Deposit at regular time intervals.

LONG TERM DEBT

Long Term Debt (LTD) is any amount of outstanding debt a company holds that has a maturity of 12 months or longer. These are various types of long term debts available in the market. Some of them are explained below.

1. BONDS

Bonds are long term secured investments in which investors lend money to a company or a corporation. They are secured because holders of a bond are paid first when a company is dissolved. The return received from it is low in comparison to debenture holders.

2. DEBENTURES

Debentures are long term securities issued by corporates yielding a fixed rate of interest. They are not as secure as bonds as investors have to depend on the creditworthiness of the companies. Debentures provide higher returns as compared to bonds. They can be easily purchased but the risk is also higher in this investment.

6. HOW TO REGISTER A STARTUP IN INDIA?

STEP- 1 INCORPORATION OF STARTUP

One must first incorporate your business as a Private Limited Company or a Partnership firm or a Limited Liability Partnership. You have to follow all the normal procedures for registration of any business like obtaining the certificate of Incorporation/Partnership registration, PAN, and other required compliances.

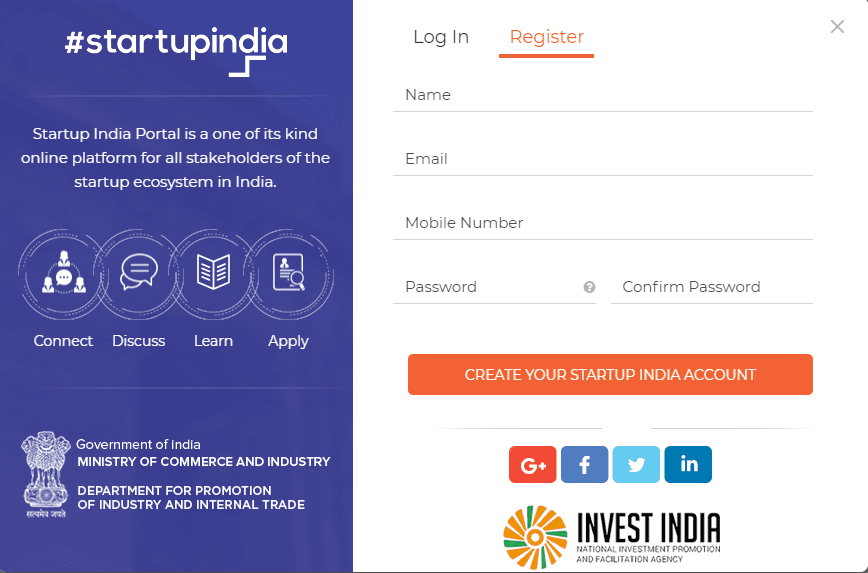

STEP – 2 REGISTER WITH STARTUP INDIA

STEP- 3 YOU MUST SELF-CERTIFY THAT YOU SATISFY THE FOLLOWING CONDITIONS

a) You must register your startup as a Private Limited Company, Partnership firm or a Limited Liability Partnership

b) The startup should not be registered more than 7 years.

c) The turnover of the startup should be less than 25 crores per year.

d) Innovation is a must- The startup must work either towards innovating something new or on improving the existing used technology.

e) Your startup must not be a result of the reconstruction of an existing business.

STEP 4 – IMMEDIATELY GET RECOGNITION NUMBER

On applying you will immediately get a recognition number for your startup. The certificate of recognition will be issued after the examination of all your documents

7. HOW TO CALCULATE YOUR STARTUP VALUATION?

IF YOUR STARTUP NEEDS MORE FUNDS, YOU GO TO PRIVATE INVESTORS AND CONVINCE THEM FOR MORE MONEY.

THERE ARE 2 WAYS TO CALCULATE THE VALUE OF YOUR STARTUP

1. Scorecard Method

- Under the scorecard method, we compare a startup to other startups of the same category and are at the same stage.

- We take an average of investments taken by them.

- A comparison is made by adding and subtracting some percentage of the average valuation. This is based on various factors like management skills, infrastructure, patents, competition, etc.

- Nowadays this method is rarely used.

2. VC Method

To understand VC Method we will take the help of an example.

Suppose the current sales of a startup is 10 crores. The VC feels that he/she can sell the startup 10 times more to a bigger company after 5 years. The valuation of your startup after 5 years is 10 times that is 100 crore. We take the assumption that the company will earn a 100 per cent return on sales. This implies that after 5 years the valuation of the startup would be 100 crores.

4 years after, it will be 50 crores,

After 3 years- 25 crores, And after 1 year the value will be 6.25 crore. This is the current valuation.

There can be fluctuations as what we assume may not prove to be true. This depends on various factors that we discussed in the scorecard method. Here the 100% rate of return represents the internal rate of return. The valuation after 5 years that we discussed is known as the exit value of the startup.

The current valuation is the post valuation of the company. It is the valuation of a startup before the VC takes the commission. After subtracting it, the left amount is the pre-valuation.

Pro tip -: A startup owner should always focus on negotiating with investors on post valuation and not pre-valuation.

8. HOW TO PITCH INVESTORS?

Pitching investors is not as easy as it seems. Many famous companies were rejected by investors.

HERE I WILL DISCUSS THE BASICS ON WAYS TO PITCH AN INVESTOR.

THERE ARE TWO TYPES OF FINANCES-

1.Traditional Financing

- Under this, you ask for loans from our family members or friends. you have to return this amount at a specific rate of return.

- The other way is you invest your savings in the startup.

2. Private Financing

- Under this, you ask for investment from angel investors or venture capitalists

- Private financing is risky as investors want to receive returns by 5 years.

PHASES OF INVESTING

To finance the startup, there are three phases that you should follow. You should remember that you do not ask for money from the investors in the beginning.

Phase 1 – Bootstrapping

Business Bootstrapping is investing your money into the startup. It is important for a startup owner to first invest his/her reserves in the business to establish its infrastructure.

Phase 2 – Ask Family or Friends for loans

Now suppose your funds from bootstrapping are finished. What to do now?

in this phase, you will ask for money from friends and family members. you will borrow money from them at a certain rate of interest. It would not liquidate your equity and you will be able to run the startup for some time.

Phase 3 – Ask for investment from big investors

Now suppose your company has achieved a breakeven point. you are earning some revenues too. Now you need money to grow your startup. In this phase, you will pitch your idea so they can invest in your business.

These can be angel investors, venture capitalists or both. You will lose equity for the amount you acquire. What do you need to do if you lack money? you need to check two things –

1. Scalability –

Will you be able to expand your startup?

2. Revenue Stream

How much revenue will the startup be able to earn in the upcoming years? If you can fulfil these things, there is a possibility that you will get early investments. Getting investments depends upon certain hidden factors as well like,

- Quality of Team

- Product/ Service.

Pro Tips:

- Never say that your product/service does not have competition. Reason- the investors might feel that its market is entirely new and it will be tough to establish and promote it. Chances are that they would not get the investment.

- Always be informed about the amount of money you need to take from investors and where are you going to invest in.

HOW TO CONTACT INVESTORS?

Many times people ask me how should they contact investors for their startup? Where can they find them?

HERE IS A STEP BY STEP GUIDE ON HOW TO CONTACT INVESTORS FOR STARTUP.

THERE ARE TWO TYPES OF FINANCES-

1. List of investors

List down famous angel investors/ venture capitalists who have invested in a similar business. Jot down the names of prospective investors who you wish that they invest in your startup

2. Try to find them on websites like LinkedIn

The next step is to find those various websites like LinkedIn. You get a lot of information about them from their profiles including the way to contact them.

3. Research about investors and jot it down

Research everything you can about the investor. It includes their likes and dislikes, companies that they have invested in, their background, etc. Jot it down. You should know about your investors well. This helps to create a good impression.

4. Attend industry-related events and participate in B-Plan events

To meet new investors, attending business-related events, proves to be helpful as you can pitch your ideas to the investors you meet and set up a meeting with them. It helps in building contact with big investors and helps in getting finance. One more way to contact investors is by participating in B-Plan competitions. In these types of competitions, you usually pitch your startup idea to judges and sometimes if your idea is really good the judges help you get investments.

You must go to only those events which are beneficial for your startup because some events are paid and you can’t afford to waste money.

5. Draft a good email and try to meet them.

When you pitch investors, draft a good email to send. It makes your startup look attractive. Try to meet them and set up an appointment to discuss your startup idea and ask for investments.

HOW TO PREPARE BEFORE MEETING THE INVESTORS?

Many times people ask me how should they contact investors for their startup? Where can they find them?

IT IS IMPORTANT TO KNOW YOUR PITCH PROPERLY.

1. Know your pitch

Never waste the time of the investor as you deliver the pitch for your startup. You should be very clear about what are you going to present in front of investors. It means you introduce your idea to the investor and try to set up a meeting with him/her. It is not a formal engagement.

Note: The first impression is the last. Try to have a good impact on the investor. Elevator pitch should be customized according to investors and based upon their facial expressions and personality.

2. Know the pitch.

Always remember what you say while delivering your pitch. To present a good pitch do not memorize it. Practice it thoroughly. Try to narrate your pitch different people like your family, friends, etc. to get a flow and try to correct flaws.

3. Share the ideas of your startup.

We often don’t share our startup ideas with people. The reason behind this is we fear is that it might get stolen. This sometimes proves to be our mistake.

4. Find and Plan your goals.

You should know what your ultimate goal of taking investment. What are you going to achieve in the upcoming years in your startup?

Convince the investors based on your revenues and milestones of business. Show your positive side to the investors and manipulate them into giving you the investments.

6. Know your investors well.

To have a good impression on the investor, try to research everything about him/her. Try to know his/her attitude, achievements, companies invested in, etc. by researching about them on various websites.

HOW TO MAKE PITCH/PRESENTATION?

Many times people ask me how should they contact investors for their startup? Where can they find them?

MAKE PITCH/PRESENTATIONS FOR YOUR INVESTORS

1. Purpose

You should know why have you started this startup. How is it going to help you? What is the purpose behind starting the startup?

2. What problem does the product/service solve?

It is important to know what audience does your product/service caters to. For the presentation, you should understand the requirement of the product in the market. What problems will the product/ service solve?

3. Market size

It means that what is the total market size of your product.

- TAM ( Total Addressable Market) – Size of the market will that your product will be able to address.

- SAM (Segmented Addressable Market) – Size of the market that comes under your sector.

- SOM (Share of Market) – Size of the market that your startup will be able to capture.

4. Demo of product

Give a demo of your product/ service to the investors. You show what the product is, what are it is features and what benefits they will get if they invest in it.

5. Competitors

To have a good impression on the investor, try to research everything about him/her. Try to know his/her attitude, achievements, companies invested in, etc. by researching about them on various websites.

6. A BUSINESS MODEL IS AN IMPORTANT PART OF THE PITCH.

I HAVE CURATED MORE THAN 64 BUSINESS MODEL VIDEOS. CHECK THE PLAYLIST BELOW:

7.Revenue and Expenses

You should have a clear idea about how are you going to earn revenue. What will be your marketing strategy? How will you invest your money? What is the duration of the break-even point?

You must showcase expenses that will be incurred, salaries will you pay. Explain the cost to make the product and the expenditure on marketing. Describe the burning rate and surviving cost of your startup. it is the amount of money you spend in a month or year. Surviving cost is the minimum amount your startup needs to survive. You must always give realistic figures that are believable to establish a trust for the startup. What you need to do is try to ask for investment from them at a certain rate of return.

8. Team

Describe the qualifications and expertise of the team in your Presentation. A good team can create wonders for a good idea. Try to establish confidence for your team members towards the investors. Always try to answer the questions with confidence to show that you have proper knowledge of how are you going to run the startup. Be honest about what you think and feel about the startup and try to be realistic.

After pitch you should ask certain questions to them like

- What will be their role in the startup?

- What will they provide?

- How are they going to invest i.e will they pay in instalments or lump sum.

- How many people are involved in the startup from their side?

Pro tip -: Have proper information about everything when you sign a contract with investors.

CONCLUSION

After you have presented everything, the decision lies with the investors.

There are two possibilities-:

- Accepts your offer

- Refuses to invest

WHAT IF INVESTOR REFUSES?

WHAT IF THE INVESTOR REFUSES?

1.React respectfully

Never respond rudely to the investors if they refuse to invest in your startup. Be polite and accept their decision.

2.Respond authentically and honestly

- React authentically,

- Be honest

- Control yourself

- Do not fake your reaction

3. Take feedback for next pitch

Try to take a feedback from them. Ask what you lacked in the presentation and what you can improve in the next pitch.

4. Follow-up for future milestones

Ask the investors if they need a follow up on how the startup functions in the future and the milestones it achieves.

It helps to create a good impression of them. If you require money in the future, you can easily approach them.

WHAT IF INVESTOR AGREES?

1. Terms and conditions

Ask the terms and conditions of the Startup. Will they work with them or not.

2. Investment criteria/ cash flow

It means that how are they going to invest. Will they pay in instalments or lump sum. How will that affect the cash flow?

3. Interference

You need to know how much they will interfere in the functioning of the business. What will be their role in the startup?

4. Assistance

Try to ask for assistance in the startup. This means that if you have a problem regarding anything which you aren’t able to solve, they will guide and help you to solve it.

5. Feedback

Ask for feedback regarding your pitch and problems in your pitch which you can improve in the next pitch.

6. Maintain a good relationship

After receiving investment, try to maintain a good relationship with the investor. You should not abandon your investors. Ask for advice and suggestions at regular intervals and keep them updated regarding the business.

9. FUNDING CONTRACT

WATCH THIS VIDEO ON FUNDING CONTRACT

1. Get a majority in the board of directors

After getting investments, your main focus should be to gain control over the startup. The investors will try to get majority seats in the board of directors who are responsible to run the startup.

Control over equity does not ensure a majority in the board of directors. as a startup owner, you should focus on getting the majority on the board of directors.

Reason- The startup idea is yours and you have put together everything. to ensure the proper functioning, the control should be in your hands.

2. Tag-Along Clause

A tag-along clause allows minor shareholders to tag along with a larger shareholder or group of shareholders if they find a buyer of their shares. It ensures that minor shareholders are not left behind if a big shareholder decides to exit the startup.

3. Drag Along with Clause

Drag along clause protects the right of big shareholders. Suppose a big shareholder finds a prospective buyer for the startup. He/she wants to sell the venture. According to this clause, he/she can drag other small investors to sell the entire venture.

4. Share option pool

A startup usually doesn’t have enough money to give salaries to employees. What they do is they give share options to employees. This means that the startup is giving a part of equity to their employees as salary. This helps in developing their interest in the startup as their salary depends upon the revenues of the startup.

5. A BUSINESS MODEL IS AN IMPORTANT PART OF THE PITCH.

10. WHY DO STARTUPS FAIL?

10 REASONS WHY

STARTUP FAILS

1.Wrong market/industry selection

There is a possibility that the market or the industry that we choose is not appropriate. For example, you are in the E-Commerce industry and your competition is with large e-commerce companies like Amazon. Chances are that you would not survive in the heavy competition. The reason behind this is you would not be able to match their level.

2. Faulty business model

Sometimes our business model is faulty. This implies that there is a problem with our calculations of revenues and expenses, which leads to losses.

3. Marketing myopia

It means you do not serve what the market demands. Reason- You provide outdated technology which the market does not want. This results in the loss of a considerable market share.

4. Weak feedback system

Week Feedback system leads to marketing myopia. If the company doesn’t employ the suggestions of customers, they lose their share in the market. Every company needs to adapt to a constantly changing environment.

MARKETING MYOPIA

5. No skill

You can’t run a startup or company if you don’t have skills for it. You might face problems if you do not have the appropriate skills to run the business. Being the boss of the startup, you should t solve the problems of your employees. A good manager is a need for a startup. Your startup may turn into a blunder.

6. No passion for business

You need passion if you want to run your startup efficiently. if you are starting a business by copying others, you might fail. Do not run the business for the sake of running it.

Reason- You would not put effort into the startup as you lack interest in it or do not care about it.

7. Wrong team selection

A startup fails if the team is wrong. Suppose they do not have the required qualities. No matter how good your idea is, the startup can fail. The team should have appropriate knowledge and skills in the field they are supposed to work. This means that the team is not competent and lacks skills and expertise.

8. Do Not know how to raise funds

A good idea is of no use if you can not raise funds. Reason – You will not be able to sustain in the market.

9. Do not know the cash burn rate

The cash burn rate means the amount of money required to run the startup for 1 month. Startup owners don’t have an idea about daily expenses incurred in the business. Suppose your revenue is around 10 lakh rupees and your startup incur expenses are worth Rs. 1 Lakh in a month. This implies that the burning rate is 10 times. Ensure that your startup gets profitable in the period else you’ll be in loss.

10. Raising funds at an early stage

One of the major mistakes that startup owners commit is they raise funds at an early stage. Reason- You lose your equity at a primary stage and lose control over the startup. Raise funds when your startup achieves the break-even point.

11. FRAUDS IN A STARTUP

You may have heard about various cases of fraud that startup owners commit with investors. I will discuss what these frauds are and how do they happen.

LET’S DISCUSS THESE STARTUP FRAUDS AND HOW DO THEY HAPPEN.

1. Dissolving the equity to increase personal net worth

Startup owners sell their share of equity at high prices. this results in increased net-worth of the startup owner. Suppose the startup is in loss or is not earning revenue. Even then the startup owner’s net worth will rise.

2. Increase in the salary of owners by using the money of investors

It is using the money received from investors to develop the startup is used for personal gains that mean increasing their salary. The startup owners don’t think about the revenues and expenses of the company and use a huge amount of investment to fulfil personal purposes.

12. E-COMMERCE BUSINESS MODELS

There are two types of E-Commerce Business models

- Marketplace

- Inventory

E-COMMERCE BUSINESS MODEL

1. Market place

- The sellers list their products on the website and the company gets a commission.

- Sellers do the packaging. If they are not able to do, additional charges are levied.

- Courier partners directly take it from the sellers.

Advantages

If products get damaged, the entire responsibility lies with the seller.

Disadvantages

The profit margin is less here.

2. Inventory

- Products are directly purchased from manufacturers and sold to consumers.

- Here the inventory is packed and directly sold to buyers and all the profit is consumed by the company.

Advantages

The profit margin is high

Disadvantages

The responsibility of damage lies with the company.

Guide to start E-Commerce a website

- Product differentiation (unique product) for competitive advantage

- Calculate expenses and plan everything.

- Don’t spend rashly without getting at a break-even point.

- Take the salary only after covering all expenses like salaries.

- Products are directly purchased from manufacturers and sold to consumers.

- Here the inventory is packed and directly sold to buyers and all the profit is consumed by the company.

13. TOP 50 STARTUP IN INDIA

In this entrepreneurial world, every other person writes CEO/Entrepreneur in his Bio & But what it takes to stand out the crowd? The following are the top Startups that deserve to be at the top in their entrepreneurial journey and we appreciate all the hard work they have done to make it more than just a startup.

14. BEST TIME TO TAKE FUNDING FOR YOUR STARTUP

- Calculate the time that will be taken to achieve breakeven.

- Decide the way you will achieve breakeven.

- Do not let the startup dissolve. This should be done when it is important.

- Have the maximum share in the startup.

15. STARTUP INDIA

Startup India is an initiative taken by the Government of India under the leadership of Narendra Modi to simplify the process of registration existing under License Raj and promoting entrepreneurship within the country.

It was launched on 16th January 2016 to make India a country of job creators from job seekers.

STARTUP INDIA FT ASSET YOGI

BENEFITS:

- Set up a 10,000 crore startup funding pool.

- Gave a reduction in patent registration fees.

- with the help of improved bankruptcy code, now the time to exit the business has been reduced from 180 days to 90 days.

- It gives freedom from mystifying inspections for the first 3 years of operation.

- Freedom from Capital Gain Tax for the first 3 years of operation.No tax will be levied on capital gains of startups for 3 years.

- Freedom from tax for the first 3 years of operation.

- Created an Innovation hub, under the Atal Innovation Mission.

- Targets 5 lakh schools, and involve 10 lakh children in innovation-related programs.

- Encourage entrepreneurship within the country.

- Promote India across the world as a startup hub.

- Built Startup Oasis as Rajasthan Incubation Center

- The startup will be eligible for government tenders against big companies.

- 75 Startup support hubs have been set up by the government in NITs, IITs, IIScs, IIITs, IISERs, etc.

- Startups shall be allowed for self-certification through the Startup mobile app with 9 labour and environment laws. In the case of the labour laws, no inspections will be conducted for 3 years.

WHAT WILL BE CONSIDERED AS A STARTUP?

1. A startup needs to be incorporated as a private limited company or registered as a partnership firm or a limited liability partnership in India

2. Startup up to seven years from the date of its incorporation/registration is considered a startup. In the case of a startup in the biotechnology sector, the period shall be up to ten years from the date of its incorporation/registration

3. The turnover of a financial year should not exceed 25 crores.

4. A company is considered a startup if it is working towards innovation, development or improvement of products or services, or if it is a scalable business model having a high potential of employment generation or wealth creation.

HOW FUNDS ARE RELEASED?

The government’s motive is to create a domestic source of capital for seed and early-stage companies.

To provide equity funding support for the development and growth of an innovation-driven startup, the government has set aside a corpus fund of 10,000 crores managed by SIDBI.

The Fund is like Fund of Funds.

The Government participates in the capital of SEBI registered Venture Funds.

PROBLEMS

- Healthcare Sectors have not got due recognition

- Funds are not properly deployed

- Administration issues

WHAT NEEDS TO BE DONE?

- Strong Startup Support Infrastructure is needed to facilitate critical business requirements.

- Bureaucratic hurdles need to be identified and eliminated.

- The implementation of programs should be done properly.

Nice Blog ?

Thank you for sharing.

Amazing

Really Informative!?

Thank you for sharing?

Really Informative!

Thank you for sharing?

Awesome blog!

Thank you for sharing!

Its an awesome and most detailed blog.

But, the section of short term debt and long term debt both have same description. Do edit it as it can be noticed easily. Your well wisher.

Amazing blog! Thank you for sharing!

Great blog!

Really informative…

What a research!

Very informative

amazing blog

Thank you sahil sir.

Please make this type more content.